Nobody is talking about a recession now as the majority of the population reached a consensus that the world is going through an unprecedented economic crisis manifesting itself. Normal cyclical economic downturns have well-established matrices to measure its impact, but this is not realistically possible in a pandemic-induced recession in which economic activity has come to a screeching halt across the globe. Truly Covid-19 pandemic and cessation of economic activity is a “Black Swan” event.

The financial industry, specifically, lending business, is one of the worst-hit by the ongoing upheaval. From spiraling unemployment to absolute stoppage of manufacturing to supply chain disruption to disruption in a services business is severely impacting the consumers’ ability to honor their financial obligations. Besides, the nature of the pandemic is also forcing the change in human behavior.

The answer lies in accelerating the process which many lenders are already planning to adopt. Lenders must determine the best options for their immediate business needs and execute the most efficient operational models in the entirely changed world after Covid-19.

About the operational model change in the Lending industry, there are two key areas the default management department of Lenders must focus now to tide through these challenging times: –

Lenders are facing a double whammy. On the one hand, the number of defaulting accounts is expected to surge, and on the other hand, resources will get scarce to address the spiraling delinquencies. To overcome this tide, Lenders should prevent a borrower from getting into a Defaulter bucket rather than try to cure post Default.

The current scenario is not going to be a short-term phenomenon. When social distancing is advocated for health reasons, collections through conventional collection centers are not sustainable. The expected enormous volume of collectible accounts after the lock-down period requires an entirely different approach to the collection process.

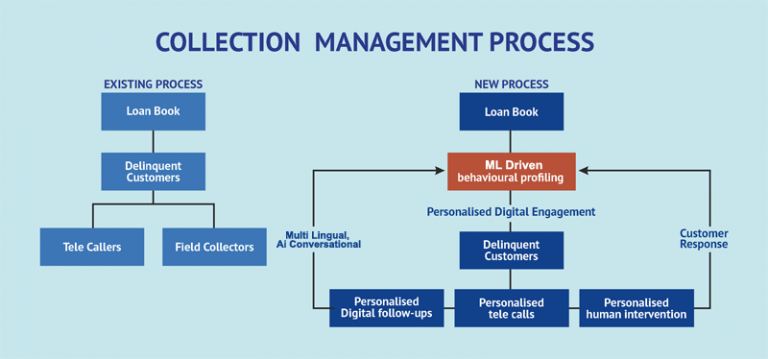

Solution! The Lenders need to adopt a more data intelligence-driven approach along with Digital technologies for customer management; in fact, Lenders should treat the process as a Default Management process and not as a Debt Collection process.

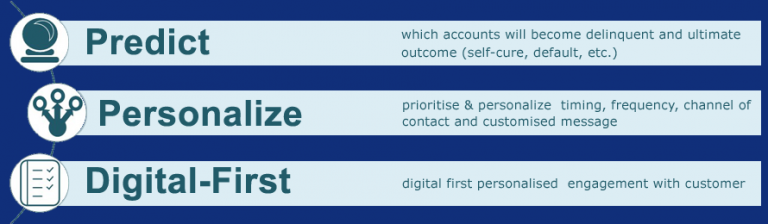

Dynamically monitoring the portfolio and understanding the changes in the behavioral economics of the borrower are key to predict future delinquencies, especially in trying times such as the current situation.

Therefore, an Early Warning System which goes beyond the conventional key performance indicators and is based on advanced analytics should be in place.

In a highly volatile environment such as now, macro segment level collection strategies based on customer demographics no longer works. A Default Decision Management system that is very dynamic, customer behavioral economics driven and the one that provides personal treatment for collection is the need of the hour.

For example, the recent travel history of the customer or/and the particular employment industry might become a significant variable in arriving at the delinquency probability of borrowers.

Early Warning System and Default Decision Management System can proactively prescribe actions at an individual borrower level to reduce the overall bounce rates substantially.

The evolution of technology choices and the ubiquitous presence of the internet has altered the communication preferences of the borrowers in recent times. To yield effective results, Lenders’ collection processes should adapt to this shift.

Adopting digital collection follow-ups as the first line of collection process through channels such as text, messengers, email, chat, mobile apps, and the web provide personal choices and anonymity for borrowers when it comes to the method and timing of response and payments. Hence, digital-first follow-up actions tend to be effective.

Debt collection is a tricky business in that the Lender needs to collect the due that the borrower owes but, at the same time, provide a good customer experience. The key to achieving this objective is Empathy. Communication choices and content play a key role in showing the Empathy that borrowers expect as an individual human being.

However, with numerous customer segmentations, it is difficult to achieve this goal through manual methods. Our AI-enabled digital execution platform can offer a tailor-made communication strategy to achieve this objective.

In scenarios where the borrower has multiple credit obligations, the borrower will likely fulfill the obligations of the creditor with whom he/she has an empathic relationship.

To start with, Lenders should move from Collection Management to Debt Management. This requires an entirely new strategy relying on more on Data-driven decision making and pro-active digital-first personal treatment rather than conventional reactive collection strategies.

Recent experiences have shown that a Combination of Data-driven and Digital-first debt management can quickly augment the over-all collected Vs. A collectible ratio over 15% within 6-9 months with a substantial reduction in the collection costs in the tune of over 30%.

©2022.CreditNirvana. All Rights Reserved.