Post Modern, Intelligent , Integrated Technology Products for Debt Management & Recovery

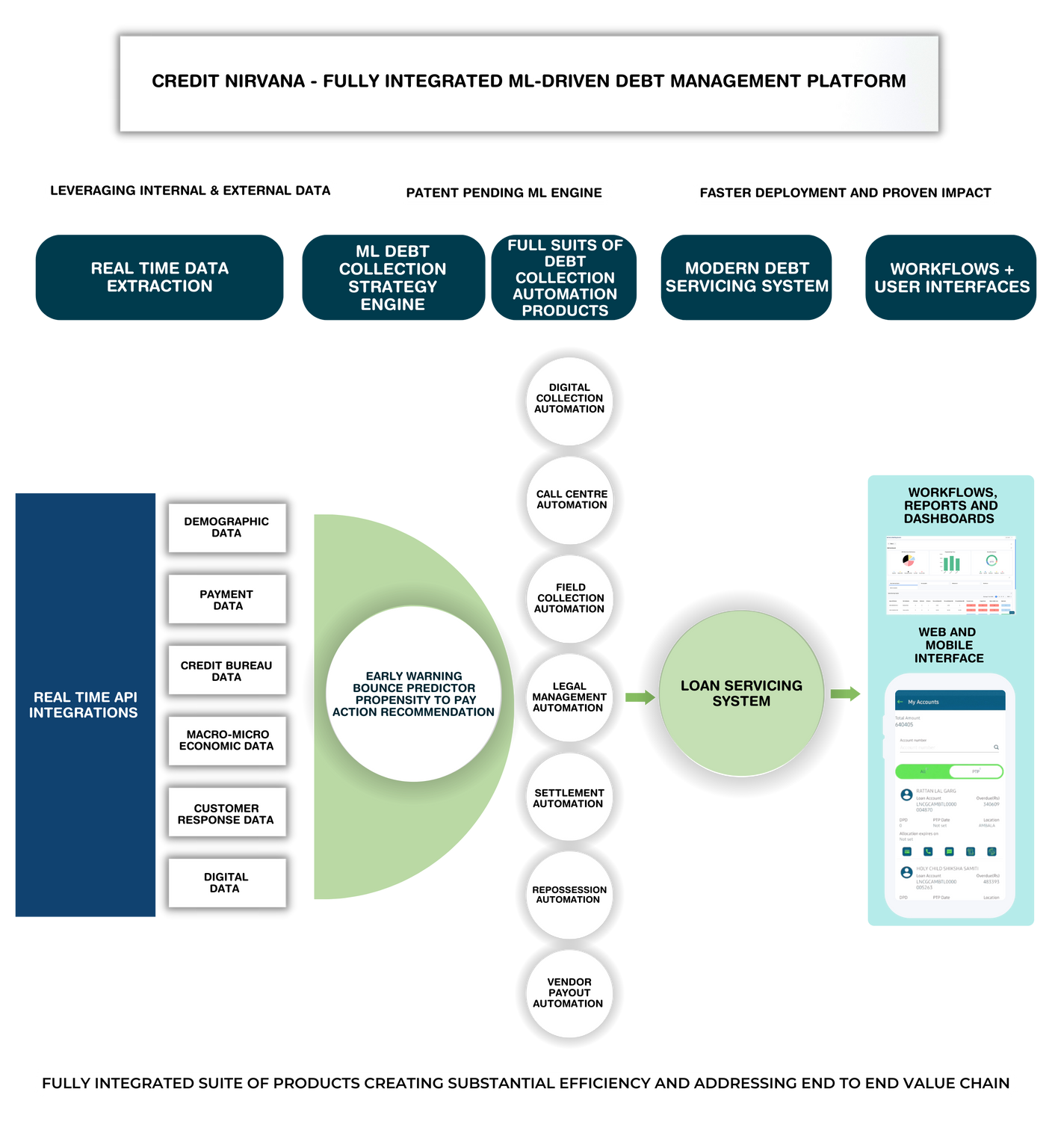

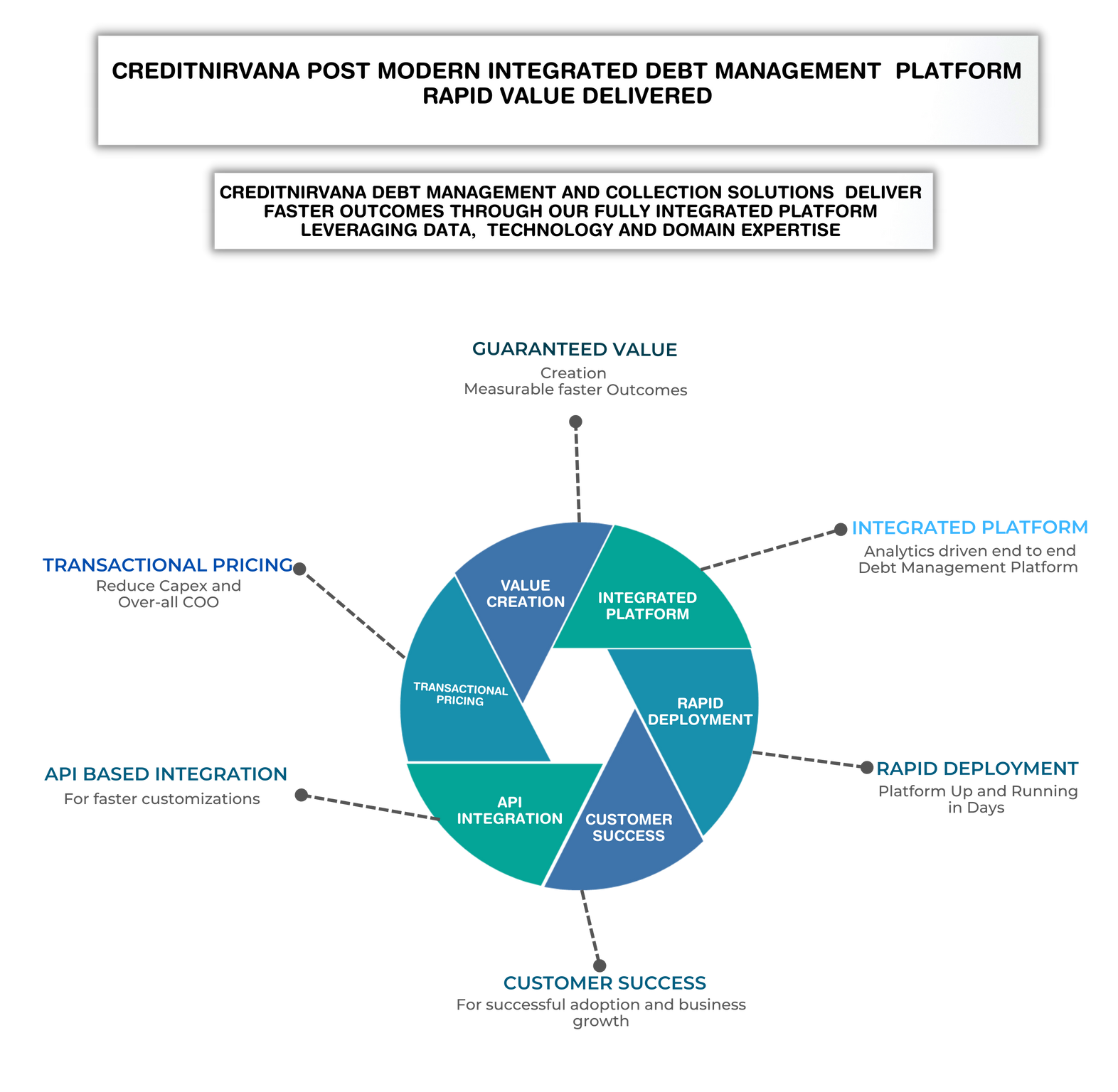

CreditNirvana’s end-to-end, fully compliant debt management platform connects Debt servicing, collections, legal, recovery, and customer follow-ups in one complete platform.

By automating operational processes, extracting insights with advanced analytics, and offering personalized experiences, CreditNirvana’s solutions improve efficiency while increasing revenue and customer satisfaction.

Innovative Products , Rapid Value Creation, Proven Impacts

Category creator providing end-to-end debt management solutions leveraging proven ML engine and Technology Architecture. One-stop market-fit platform leading to proven value creation for clients by replacing legacy players

Debt Management Products

CreditNirvana provides suites of integrated AI-based Debt Management products for Consumer & Commercial Finance, Asset Reconstruction Companies, Insurance, Telecom, Utilities, and Healthcare, which can improve your overall collection rates and lower bounce rates with a significant reduction of collection costs.

Product Platform Solutions

Our ML driven sequential delinquency prediction is going beyond traditional Early Warning Systems with dynamic long-term cash flow prediction.

CreditNirvana – EWE has been built using a great number of structured and unstructured data sets and is leveraging advanced statistical models to provide real-time and dynamic early warning signals specifically for collections.

DecisionCollect provides both NLP Driven micro-segmentation based on payment behavior as well as personalized follow-up actions & recommendations. Together with preferred communication channels & convenient date/time and communication content.

And dynamically recommends a personalized, collection treatment based on deep tech behavioral segmentation using structured and unstructured data.

RoboCollect automatically executes follow-up actions via all digital channels including Text, WhatsApp, Bots, Messenger, E-mail, and Robo Call.

Integrated with Digital Payment gateways, PayEngine facilitates end-to-end payment collection including reconciliation, settlements etc.

Industry Specific Products

Financial Services

Insurance

Telecom

Healthcare

Utilities

Mutual Funds

Financial Services

Insurance

Telecom

Healthcare

Utilities

Mutual Funds

Compliance and Data Security

CreditNirvana data security and IT policies are designed to provide the highest level of protection for your customer’s personal data.

Data Security

All information is stored in secure data centers that are ISO 27001 compliant. All data is stored in encrypted form, at rest, and is encrypted in transit.

Secure Facility

A secure physical office environment with strict document retention and funds management procedures is in place.

Monitoring and Logging

Our systems’ security and performance are constantly monitored by an extensive network of surveillance systems. Changes to our infrastructure, software, and data are monitored, logged, and regularly reviewed.

End to End ML

Collection

As a Service

Let’s help you with a FREE trial offer to help you boost Cash Flow during this challenging time. Contact us through the links below and a representative will be in touch.

Email Us: info@creditnirvana.ai