A fully integrated suite of

Debt Management products

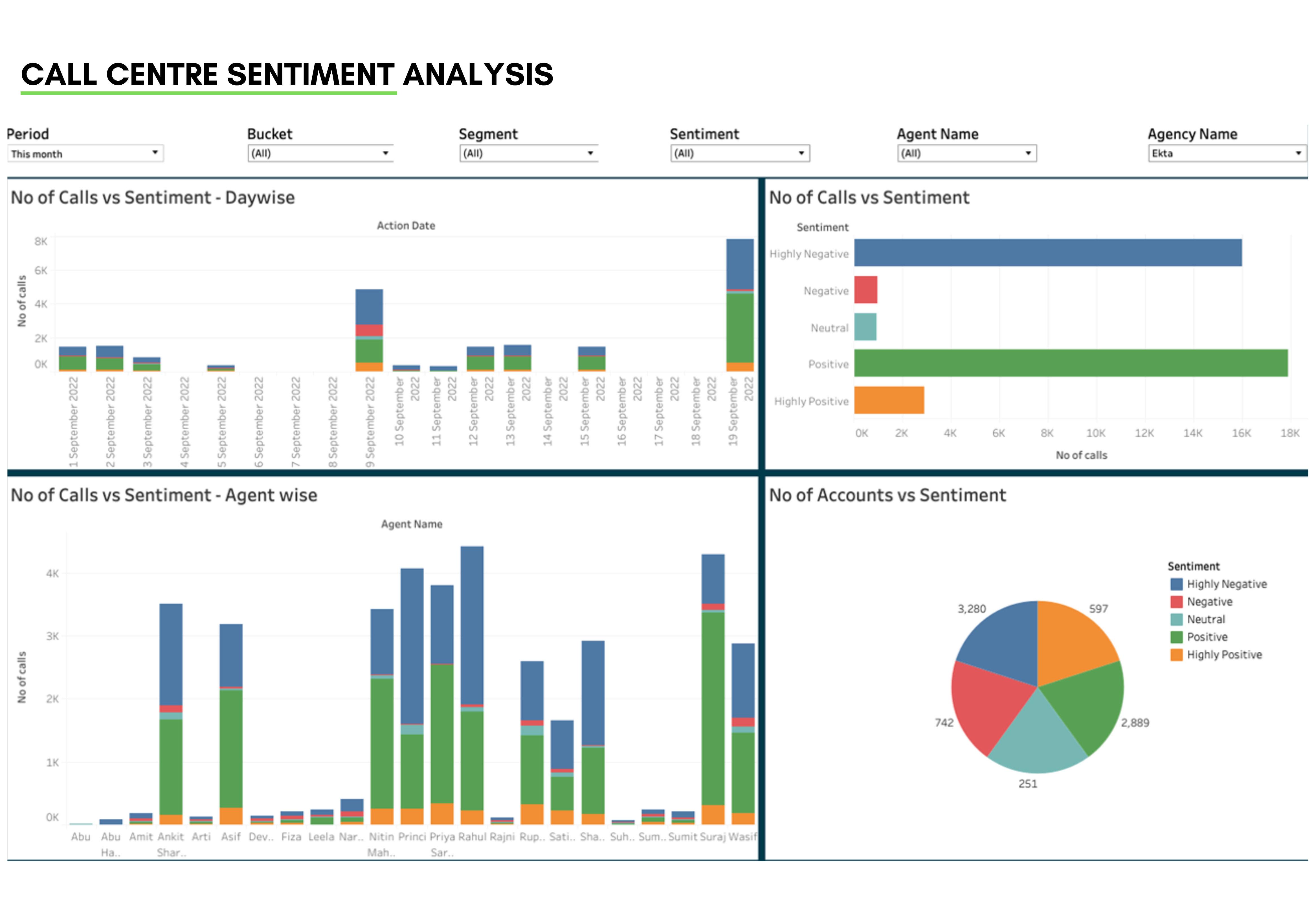

We bring together everything that’s required for entire Debt Management Process. CreditNirvana’s products power Debt Management Solutions like AI/ML Driven Collection Strategy Engine, RoboCollection – NLP Driven Omnichannel & Multilingual Digital Collection, Call Center Automation, ML & Rule-based Customer Allocation, Field Collections & GPS Enabled Field Mobile App, Agency/Vendor Management, Legal Process Automation, Repossession, Settlement, and everything in between.

We also help companies in AI Conversational Multi-lingual Digital Collection, Call Centre Automations, Digital Legal Notices Management and Legal Case Management.

Proven Platform

Proven Value Creation for Clients

Improvement in Bounce Rates

- Reduced Bounce Rates by 15-30% in 3-6 months

- Over 66% reduction in Bucket 0 bounce rate for one client

Reduction in NPL

- Reduced NPL by 10-25% in 6-9 months

- Over 60% reduction in NPL for certain clients

Reduction in Costs

- Reduced Collection Costs by 25-45% in 3-6 months

Increase in Roll Back

- Over 60% more roll back in Bucket 3 for one client

- Collection efficiency increased by 65% in Bucket 1 and over 20% in Bucket 3+ for one client

Credit Nirvana addresses key challenges faced in Debt Management Across Industries

Addressing the monthly debt collection and monthly cash flow automatically solves the NPA issue, which is considered the real problem in the lending business

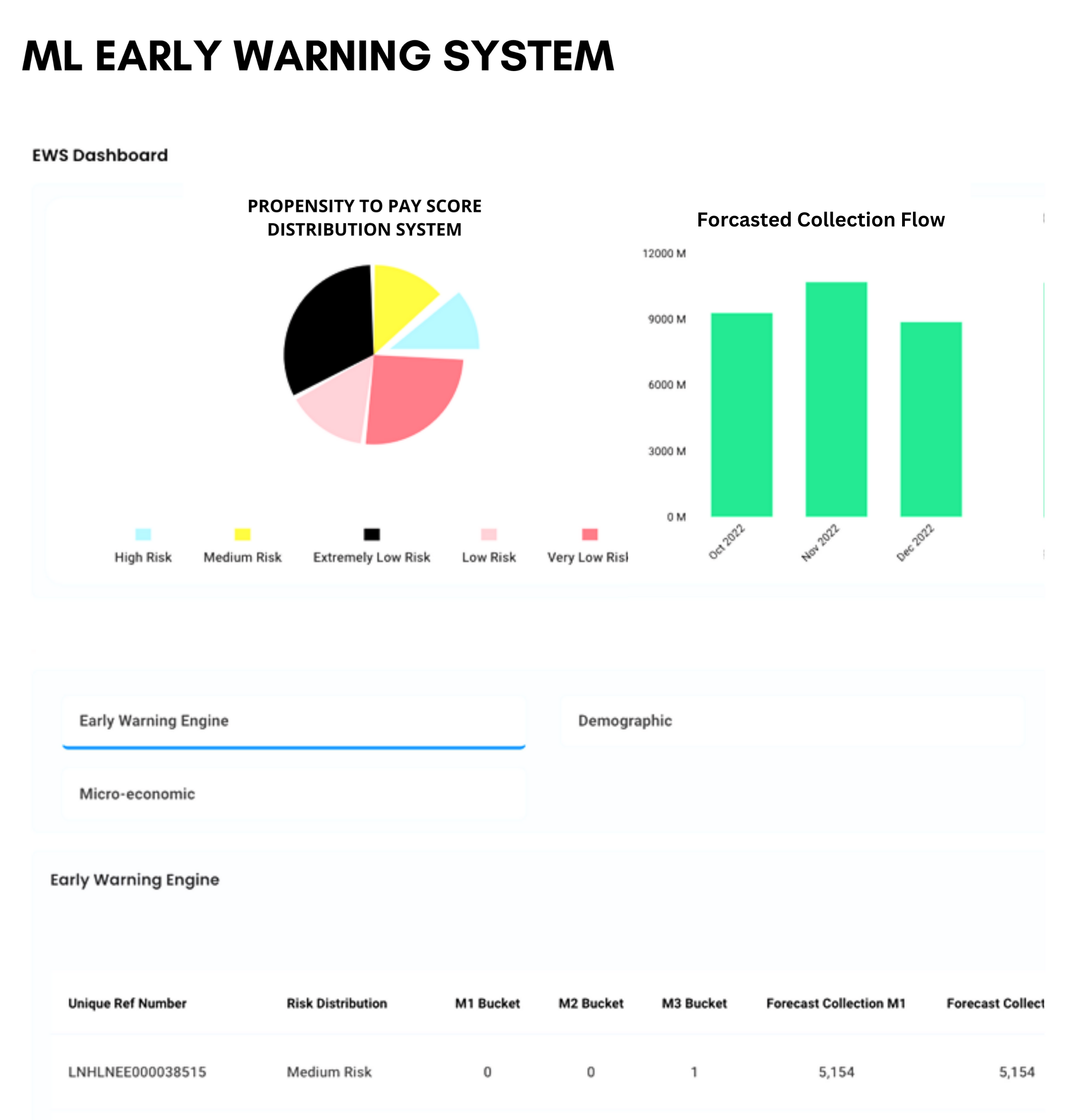

ML-Driven Intuitive Early Warning Engine with bounce predictor and collection strategy recommendation

Pro-Active, personalized collection treatments

Intelligent automation eliminating the minor tasks in the workflow

Restructure manual interventions and offer autonomous decision-making capabilities for process automation.

A tech driven direction that helps to deliver continuous personalized customer engagement

Real time customer response driven collection treatments

Single integrated platform for collection analytics to Recoveries /Repossession

Intelligent Automation of End-to-End Debt Management

Debt Management Products

CreditNirvana provides suites of integrated AI based Debt Management products for Consumer & Commercial Finance, Asset Reconstruction Companies, Insurance, Telecom, Utilities and Healthcare, which can improve your overall collection rates and lower bounce rates with significant reduction of collection costs.

Applicable Industries

End-to-End Debt collection and management

Renewals & Persistency management

Mobile/Internet bill payments